How to Create a Finance Plan That Actually Works for You

How to Create a Finance Plan That Actually Works for You – Creating a finance plan that truly works for you isn’t about following a one-size-fits-all formula; it’s about crafting a strategy that aligns with your personal goals, values, and circumstances. Whether you’re just starting out in your career, planning for retirement, or dealing with debt, having a solid finance plan is essential for achieving financial security and long-term wealth.

In this article, we’ll guide you through the steps to create a finance plan that is tailored to your needs and ensures you stay on track with your financial goals.

1. Set Clear Financial Goals

Before you can build an effective finance plan, you need to know what you’re working toward. Setting clear financial goals gives you direction and motivation, helping you focus your energy and resources on what really matters.

Types of Financial Goals:

- Short-Term Goals (1–3 years): These might include building an emergency fund, paying off credit card debt, saving for a vacation, or buying a new laptop.

- Mid-Term Goals (3–5 years): Examples include saving for a down payment on a house, starting a small business, or funding your child’s education.

- Long-Term Goals (5+ years): These could involve saving for retirement, building a large investment portfolio, or achieving financial independence.

SMART Goal Framework:

To make your goals actionable, use the SMART criteria:

- Specific: Be clear about what you want to achieve (e.g., “Save $10,000 for a down payment on a house”).

- Measurable: Ensure you can track your progress (e.g., “Save $500 per month”).

- Achievable: Set a goal that’s realistic for your financial situation.

- Relevant: Align your goals with your long-term values and priorities.

- Time-bound: Set a clear deadline for when you want to achieve your goal (e.g., “Save $10,000 in 12 months”).

2. Assess Your Current Financial Situation

Before you can create a finance plan, it’s crucial to understand where you currently stand financially. This step helps you see what’s working, where you can improve, and how much you can realistically save or invest.

Key Areas to Assess:

- Income: How much do you earn monthly, after taxes? Include your salary, bonuses, freelance income, and any passive income sources.

- Expenses: List all your fixed and variable monthly expenses. Fixed expenses include rent, utilities, and insurance, while variable expenses include groceries, entertainment, and transportation.

- Assets: What do you own? Include cash, savings, investments, and property.

- Liabilities: What do you owe? This includes credit card debt, student loans, mortgages, and car loans.

Calculate Your Net Worth:

Net worth is the difference between your assets and liabilities. To calculate your net worth, use this formula:

Net Worth = Assets – Liabilities

A positive net worth means you have more assets than liabilities, while a negative net worth indicates the opposite. Knowing this figure can give you a clearer picture of your financial health and help you identify areas for improvement.

3. Create a Realistic Budget

A well-designed budget helps you manage your income and expenses, ensuring that you’re saving and investing for your financial goals while living within your means.

Steps to Create a Budget:

- List Your Income: Start by recording all sources of income, including your salary, freelance work, and passive income.

- Track Your Expenses: Categorize your expenses into fixed and variable costs. Fixed costs remain the same each month, while variable costs can fluctuate.

- Set Spending Limits: Based on your income and financial goals, set limits for each category of expenses (e.g., $300 for groceries, $100 for entertainment).

- Allocate for Savings: The goal is to save a portion of your income regularly. Aim for at least 20% of your monthly income, if possible. Automate this process by setting up automatic transfers to savings and investment accounts.

Budgeting Methods:

- The 50/30/20 Rule: A simple method that allocates:

- 50% of income to essentials (housing, utilities, etc.)

- 30% to discretionary spending (entertainment, dining out, etc.)

- 20% to savings and debt repayment

- Envelope System: This involves using cash for specific expense categories (e.g., groceries, entertainment) and physically separating the money in envelopes to prevent overspending.

- Zero-Based Budgeting: Every dollar of your income is assigned a job—either for spending, saving, or debt repayment—leaving you with a budget “balance” of zero.

4. Build an Emergency Fund

Life is full of unexpected expenses, from medical bills to car repairs to job loss. Having an emergency fund ensures that you won’t have to rely on high-interest credit cards or loans in these situations.

How Much Should You Save?

Aim for an emergency fund that covers 3 to 6 months of living expenses. This provides a financial cushion to help you weather any financial storms.

How to Build an Emergency Fund:

- Start with a small goal (e.g., $500 to $1,000) to cover minor emergencies.

- Gradually increase your emergency fund to cover 3 to 6 months of essential living expenses.

- Keep your emergency fund in a high-yield savings account so it’s easily accessible but still earns interest.

5. Pay Off Debt Strategically

Debt, especially high-interest debt like credit card balances, can prevent you from building wealth. Paying off debt should be a priority in your finance plan, but the way you approach it can make a big difference.

Debt Repayment Strategies:

- Debt Avalanche: Focus on paying off the debt with the highest interest rate first. This method saves you money on interest over time and allows you to pay off your debt faster.

- Debt Snowball: Pay off your smallest debt first to gain momentum and motivation. Once you’ve eliminated one debt, move on to the next smallest debt. This method provides psychological benefits by giving you quick wins.

- Balance Transfers: If you have high-interest credit card debt, consider transferring your balance to a card with a lower interest rate. Many credit cards offer 0% introductory APR for balance transfers for the first 12–18 months.

Consider Debt Consolidation:

If you have multiple debts, you might want to consolidate them into a single loan with a lower interest rate. This can simplify payments and help you manage debt more effectively.

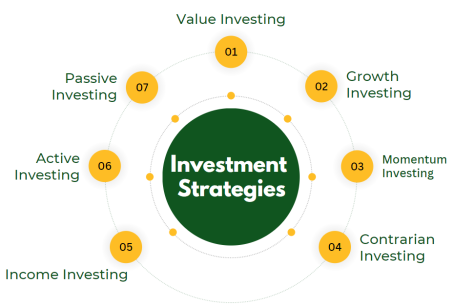

6. Start Saving and Investing for the Future

Once you’ve built an emergency fund and tackled high-interest debt, it’s time to start saving and investing for your future. Even if you’re young, starting early gives you the advantage of time and compound growth.

How to Get Started:

- Retirement Accounts: Contribute to a 401(k) or IRA to benefit from tax advantages. If your employer offers a 401(k) match, contribute enough to take full advantage of this “free money.”

- Invest in Low-Cost Index Funds: Index funds and ETFs (exchange-traded funds) are cost-effective ways to invest in a broad range of stocks and bonds. These funds are a great choice for beginners, as they offer diversification and lower risk.

- Start Small: Even if you can only invest a small amount each month, the key is consistency. Set up automatic monthly contributions to a brokerage or retirement account.

Types of Investment Accounts:

- Brokerage Accounts: These accounts allow you to buy and sell stocks, bonds, mutual funds, and ETFs. They offer flexibility, but you’ll pay taxes on any gains.

- Roth IRA: A Roth IRA offers tax-free growth, meaning you won’t have to pay taxes on your investment earnings when you withdraw them in retirement.

7. Review and Adjust Your Plan Regularly

A finance plan is not set in stone. As life changes—whether through a new job, a move to a new city, or a change in family circumstances—you’ll need to adjust your plan to stay on track with your financial goals.

How to Review Your Plan:

- Set Quarterly Check-Ins: Every 3 months, review your financial progress. Are you meeting your savings targets? Are you on track to pay off your debt? Do you need to adjust your budget or goals?

- Annual Review: At the end of each year, assess your overall financial health. Revisit your goals and make any necessary adjustments. This is also a good time to consider making changes to your investment strategy or retirement savings contributions.

8. Stay Disciplined and Patient

Building wealth and achieving financial security takes time and discipline. There will be challenges along the way, and it’s easy to get discouraged. However, staying committed to your financial plan and making adjustments as needed will pay off in the long run.

Tips to Stay on Track:

- Stay Educated: The more you learn about personal finance and investing, the better equipped you’ll be to make informed decisions.

- Stay Motivated: Celebrate your milestones, whether it’s paying off a debt, reaching a savings goal, or making your first investment.