How to Choose the Right Insurance Policy for Your Needs

Choosing the right insurance policy is essential for protecting your assets, health, and overall financial well-being. However, with the vast number of options available, the process can feel overwhelming. This guide will walk you through the steps you need to take to ensure you select the best insurance policy that meets your needs and budget.

1. Assess Your Personal and Financial Risks

The first step in choosing the right insurance policy is to assess your personal and financial risks. What aspects of your life or assets do you want to protect? Identifying potential risks will help you prioritize the types of insurance you need.

For example:

- Health risks: Do you or a family member have a medical condition that requires ongoing care?

- Home risks: Are you a homeowner or renter? Do you live in an area prone to natural disasters, such as floods or earthquakes?

- Auto risks: Do you drive frequently, and would you be at risk of significant financial loss in case of an accident?

Understanding these risks will allow you to make a more informed decision when choosing a policy.

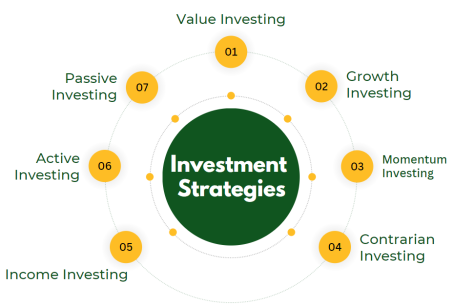

2. Understand Different Types of Insurance

There are many different types of insurance, and the best one for you will depend on your needs. Here are the most common types of insurance policies and their purposes:

- Health Insurance: Covers medical expenses, including doctor visits, hospital stays, medications, and surgeries.

- Life Insurance: Provides financial protection for your beneficiaries (e.g., family members) in case of your death.

- Auto Insurance: Protects your vehicle and offers financial compensation for accidents, theft, or damage.

- Homeowners or Renters Insurance: Protects your home and personal property from damage or loss due to fire, theft, or other covered events.

- Disability Insurance: Replaces part of your income if you’re unable to work due to illness or injury.

- Travel Insurance: Covers unexpected travel disruptions, such as canceled flights, lost luggage, or medical emergencies abroad.

Make sure to choose the types of insurance that align with your life situation and the risks you identified.

3. Evaluate Your Coverage Needs

Once you’ve decided which types of insurance you need, the next step is to evaluate how much coverage you require. The amount of coverage will vary depending on your situation.

- Health Insurance: Consider your age, health status, and any chronic conditions. You may need a more comprehensive plan with lower out-of-pocket expenses if you anticipate frequent medical visits.

- Life Insurance: Your life insurance needs will depend on your family’s financial situation. If you have dependents, make sure the policy provides enough coverage to support them in case of your death.

- Auto Insurance: Check if your car is new or older. Newer cars may need full coverage (which includes collision and comprehensive), while older cars might only need liability coverage.

- Home Insurance: Evaluate the value of your home and belongings. If you live in a high-risk area, you may need additional coverage, such as flood insurance.

Make sure the policy offers enough coverage to protect you adequately in case of a claim, but avoid over-insuring as this will lead to unnecessary premium costs.

4. Compare Insurance Providers

Not all insurance providers are created equal. When choosing a policy, it’s crucial to compare different insurance companies based on a few key factors:

- Reputation and Reliability: Look for insurers with a strong track record of paying claims on time. You can check online reviews or consult with others in your community.

- Customer Service: Good customer service is essential, especially when you need assistance filing a claim. Choose an insurer that is responsive and provides support when you need it most.

- Financial Stability: Make sure the insurance company is financially stable and able to honor claims in the long run. You can check the company’s ratings from independent agencies like A.M. Best or Moody’s.

- Policy Terms and Conditions: Compare the terms of the policies, including exclusions, limits, and deductibles. Ensure you understand what is and isn’t covered.

Comparing providers ensures you choose a company that fits your needs and offers the best value.

5. Consider Your Budget

Your budget will play a significant role in determining the right insurance policy for you. Insurance premiums can vary significantly between providers and policies, so it’s essential to find a balance between coverage and cost.

Here are some tips to keep in mind:

- Shop Around: Get quotes from multiple providers to compare prices. Don’t automatically go with the cheapest option—consider the value of the coverage offered.

- Adjust Your Deductibles: Some policies allow you to lower your premium by increasing your deductible (the amount you pay out of pocket before insurance kicks in). Be sure you can afford the deductible in case of a claim.

- Look for Discounts: Many insurance providers offer discounts for bundling multiple policies (e.g., auto and home insurance) or for having a good driving record, installing safety features, or maintaining a healthy lifestyle.

Remember, while it’s important to keep costs manageable, the cheapest option may not always offer the coverage you need.

6. Review Policy Exclusions and Limits

Every insurance policy comes with exclusions—events or situations that are not covered by the policy. Before purchasing an insurance policy, carefully review these exclusions to avoid surprises later.

For example:

- A health insurance policy may not cover certain treatments or pre-existing conditions.

- Auto insurance may exclude coverage for accidents that occur while driving under the influence of alcohol or drugs.

- Homeowners insurance may not cover certain natural disasters like floods, requiring separate coverage.

Additionally, check the limits of coverage. For example, life insurance may have a cap on the payout amount, and health insurance may limit the number of doctor visits covered annually.

Make sure you fully understand what is and isn’t covered, and adjust your policy accordingly.

7. Regularly Review Your Policy

Your insurance needs may change over time, so it’s important to regularly review your policy. Significant life changes, such as getting married, buying a home, having a child, or retiring, may require adjustments to your coverage.

Reviewing your policy at least once a year will help ensure that your insurance continues to meet your evolving needs.

Conclusion

Choosing the right insurance policy is a critical decision that requires careful thought and planning. By assessing your personal risks, understanding different types of insurance, evaluating your coverage needs, and comparing providers, you can make an informed decision that protects you and your loved ones. Always remember to review your policy regularly to ensure that it continues to meet your needs as your life changes.